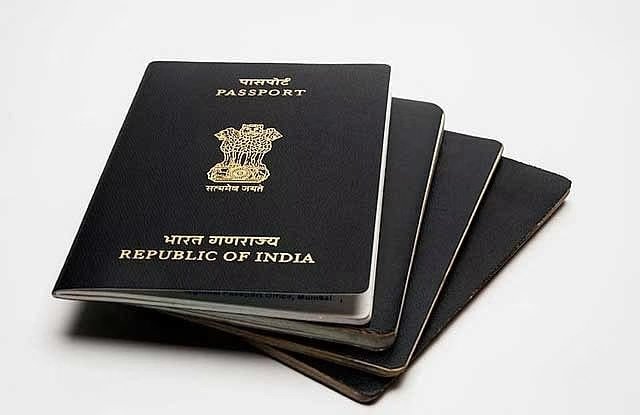

A heated debate has erupted online over the investment potential of UAE vs. Bangalore real estate, following a bold Reddit post that claims Bangalore’s property market is a liquidity trap compared to the UAE’s high-yield investment environment.

While both cities attract real estate investors, the comparison highlights key differences in rental yields, appreciation, and liquidity, leaving many questioning whether Bangalore is a sound investment or just speculative money parking.

Key Takeaways from the Debate

A Reddit user sparked controversy with a no-nonsense breakdown, stating:

• UAE outperforms Bangalore in every metric, except for initial affordability.

• Bangalore real estate suffers from slow appreciation, low rental yields, and high maintenance costs.

• UAE’s market is investment-driven, while Bangalore’s market relies on speculation.

Let’s dive into the numbers.

The Rental Yield Gap

The biggest argument against Bangalore real estate is its low rental yields, especially when compared to the UAE.

• Bangalore rental yield: 2-3% gross (before taxes & maintenance)

• UAE rental yield: 6-8% net (after expenses)

Example Comparison:

• Bangalore: A ₹3 crore apartment rents for ₹60,000/month (₹7.2 lakh/year) → 2.4% gross yield.

• UAE: A ₹3 crore apartment rents for ₹1.5-2 lakh/month (₹18-24 lakh/year) → 6-8% net yield (almost 3x better than Bangalore).

This difference is significant for investors who rely on rental income as a return on investment (ROI).

Property Appreciation: Real or Artificial?

While Bangalore’s property prices have surged, critics argue that this growth is artificial and not backed by real demand.

• Bangalore’s concern: Salaries haven’t kept pace with rising property prices, making future appreciation uncertain.

• UAE’s strength: Demand is backed by global investors, expats, and a strong rental market, ensuring sustainable price appreciation.

Liquidity: Selling a Property When You Need Cash

Liquidity is a major issue in Bangalore’s real estate market.

• Bangalore: Reselling a flat is slow and complicated, often requiring under-the-table transactions.

• UAE: Properties are easier to sell, thanks to a transparent market and high investor demand.

One user summarized the difference bluntly:

“If you ever need cash fast, your Bangalore flat is useless.”

Why the UAE Wins as an Investment Market

The UAE’s real estate market offers several advantages over Bangalore, including:

1. Higher rental yields (6-8% vs. 2-3%).

2. Stronger liquidity (easier resale, no hidden transactions).

3. A tax-friendly environment (no property tax, no capital gains tax).

4. Global investor demand, ensuring long-term appreciation.

While Bangalore remains a key real estate hub, its slow rental returns, liquidity challenges, and speculative nature make it less attractive for serious investors.

For those seeking real estate as an investment rather than just money parking, UAE properties offer significantly better returns, liquidity, and stability.