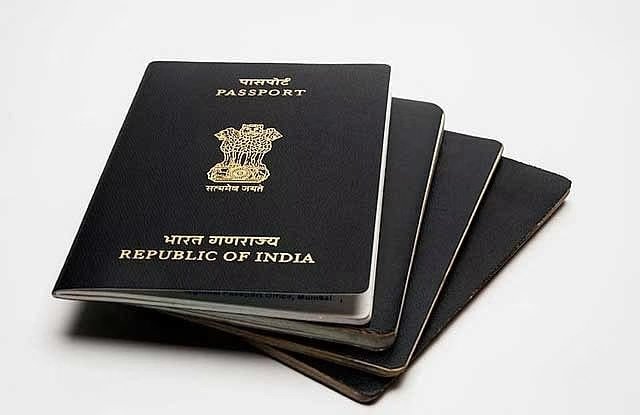

The UAE’s domestic card scheme, Jaywan, has partnered with Visa to launch co-branded debit and prepaid cards, marking a major step in the country’s financial evolution. This collaboration, announced by Al Etihad Payments and Visa, aims to enhance payment security, expand transaction possibilities, and drive digital transformation in the UAE.

With both Jaywan and Visa logos on the new cards, customers will enjoy seamless and secure transactions both domestically and internationally. The initiative aligns with the UAE’s vision of strengthening its financial infrastructure and providing a locally-rooted yet globally accepted payment solution.

What Is Jaywan?

Jaywan is the UAE’s domestic card payment system, operated by Al Etihad Payments, a subsidiary of the Central Bank of the UAE (CBUAE). It is designed to provide a secure and cost-effective alternative for local payments, reducing reliance on foreign payment networks.

Jaywan operates under UAESWITCH, the UAE’s national card switch system, ensuring smooth transactions across the country’s financial institutions. The Jaywan-Visa partnership enhances this network, offering customers broader acceptance and advanced features.

Key Benefits of Jaywan-Visa Debit & Prepaid Cards

The new Jaywan-Visa cards bring multiple advantages for UAE residents, merchants, and businesses. Here’s how they will make everyday transactions easier and more efficient:

1. Seamless Local and International Payments

• Customers can use Jaywan-Visa cards at all local merchants and ATMs in the UAE through UAESWITCH.

• They can also make secure global payments at over 150 million Visa merchants across 200 countries and territories.

• This ensures that UAE residents traveling abroad or shopping online have uninterrupted access to their funds.

2. Enhanced Security & Fraud Protection

• Transactions within the UAE will be processed through UAESWITCH, ensuring high security and regulatory compliance.

• International transactions (outside the GCC) will be routed through VisaNet, Visa’s global payment network, which provides advanced fraud detection and encryption technologies.

• Customers will benefit from dual-layer security, reducing risks associated with card fraud and unauthorized transactions.

3. Support for Digital and Contactless Payments

• The Jaywan-Visa cards will be enabled for contactless transactions, allowing users to pay quickly with a tap-and-go feature.

• Customers will be able to link their cards to digital wallets, including Apple Pay, Google Pay, and Samsung Pay, making mobile payments even more convenient.

• This supports the UAE’s digital transformation strategy, encouraging cashless transactions across the country.

4. Lower Transaction Costs for Domestic Payments

• Since domestic transactions will be processed through UAESWITCH, banks and merchants may experience lower processing fees compared to international card networks.

• Customers may also benefit from reduced fees on local purchases, making it more cost-effective for day-to-day transactions.

5. Increased Financial Inclusion

• The availability of prepaid cards allows non-bank customers and expats without a traditional bank account to access secure payment solutions.

• This initiative aligns with the UAE’s vision of financial empowerment, providing all residents with easy access to digital payment options.

6. Better Transaction Routing for Faster Processing

• Domestic transactions will be processed locally through UAESWITCH, ensuring faster payments and less dependency on international networks.

• Cross-border transactions will be handled via VisaNet, guaranteeing global connectivity and support for foreign currency payments.

UAE’s Vision for Financial Growth

According to Saif Humaid Al Dhaheri, Assistant Governor of the CBUAE and Chairman of Al Etihad Payments, the Jaywan-Visa partnership is a key milestone in the UAE’s financial development.

He stated:

“Jaywan is a key step toward strengthening the UAE’s financial infrastructure, offering a locally rooted payment solution that supports economic growth and digital transformation. Under this partnership with Visa, we are creating a seamless, secure, and efficient card payment ecosystem that aligns with the UAE’s vision for innovation and financial empowerment.”

The UAE has been actively working to develop a stronger domestic financial ecosystem. The introduction of Jaywan-Visa cards complements this effort, reducing dependence on foreign card schemes while offering customers the convenience of international transactions.

What This Means for Customers and Businesses

The Jaywan-Visa cards will benefit:

• Consumers: More secure, faster, and widely accepted payment options.

• Merchants: Lower transaction fees and expanded digital payment adoption.

• Banks & Fintech Companies: More efficient and cost-effective payment processing.

• The UAE Economy: Greater financial independence and improved digital payment infrastructure.

Conclusion

The Jaywan-Visa partnership is a game changer for the UAE’s banking and payment industry. By combining the strengths of Jaywan’s local infrastructure and Visa’s global reach, this initiative ensures greater payment flexibility, enhanced security, and financial inclusion.

As the UAE continues its digital transformation, the launch of Jaywan-Visa cards marks a significant step toward a cashless and more financially empowered nation.