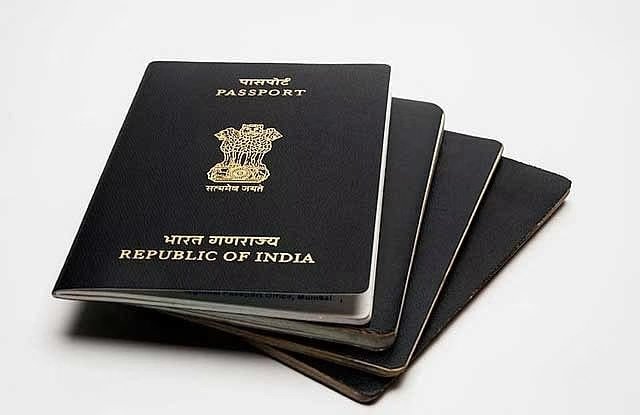

India’s Supreme Court has issued a final ultimatum to Nowhera Shaik, managing director of Heera Group, to repay Rs 250 million (Dh10.57 million) within three months or face jail. Shaik, accused of orchestrating a Ponzi-style gold investment scheme, allegedly defrauded over 100,000 investors, including hundreds in the UAE, out of Dh2.36 billion (Rs 5,600 crore).

The Rise and Fall of Heera Group

Heera Group, which marketed itself as a lucrative investment firm, lured investors in India and the Middle East with promises of high returns. In the UAE, Heera Gold claimed that a Dh100,000 investment would yield Dh3,250 in monthly payouts with a one-year lock-in period. Other schemes, such as Heera Textiles and Heera Foodex, offered returns of 65 to 80 percent annually on deposits as low as Dh15,000.

Thousands of investors, believing in these “guaranteed” returns, poured their savings into Heera’s schemes. Some even took out loans to maximize their investments. However, in 2018, the payouts abruptly stopped, leading to widespread panic. The company collapsed, leaving investors in financial ruin.

Legal Battle and Supreme Court’s Ruling

Nowhera Shaik was arrested in October 2018, but legal proceedings have dragged on since then. Investors, desperate to recover their money, searched for Heera’s UAE offices in Jumeirah Lake Towers and warehouses in Ras Al Khaimah and Sharjah, but found nothing.

Despite repeated court orders, Shaik failed to repay investors. On November 11, 2024, the Supreme Court had given her extra time to arrange the funds, but she continued to defy the orders.

During the latest hearing, Justice JB Pardiwala issued a final warning:

“We propose, as a last opportunity, that the accused deposit Rs 250 million within three months. If she fails, her bail will be automatically canceled, and she will be sent back to jail.”

The Enforcement Directorate (ED) has also been ordered to take Shaik into custody if she fails to meet the deadline.

Where Are the Funds?

Shaik’s legal team, led by senior advocate Kapil Sibal, argued that she lacks the funds to repay investors. However, the Enforcement Directorate countered that she owns multiple properties, many of which have already been attached by authorities. Despite this, Shaik’s team disclosed only three properties—two of which, in Telangana, are now set to be auctioned.

Meanwhile, the Serious Fraud Investigation Office (SFIO) is continuing its probe, with multiple First Information Reports (FIRs) filed against Shaik in Telangana, Andhra Pradesh, Maharashtra, Karnataka, and Delhi.

A Cautionary Tale for Investors

The Heera Group case serves as a stark reminder of the dangers of high-return investment schemes. While Heera Gold initially paid dividends of up to 36 percent to build investor confidence, the model was unsustainable. When the payouts stopped, investors were left with nothing.

With Shaik now facing potential jail time, thousands of investors are still waiting for justice and hoping to recover their lost savings.